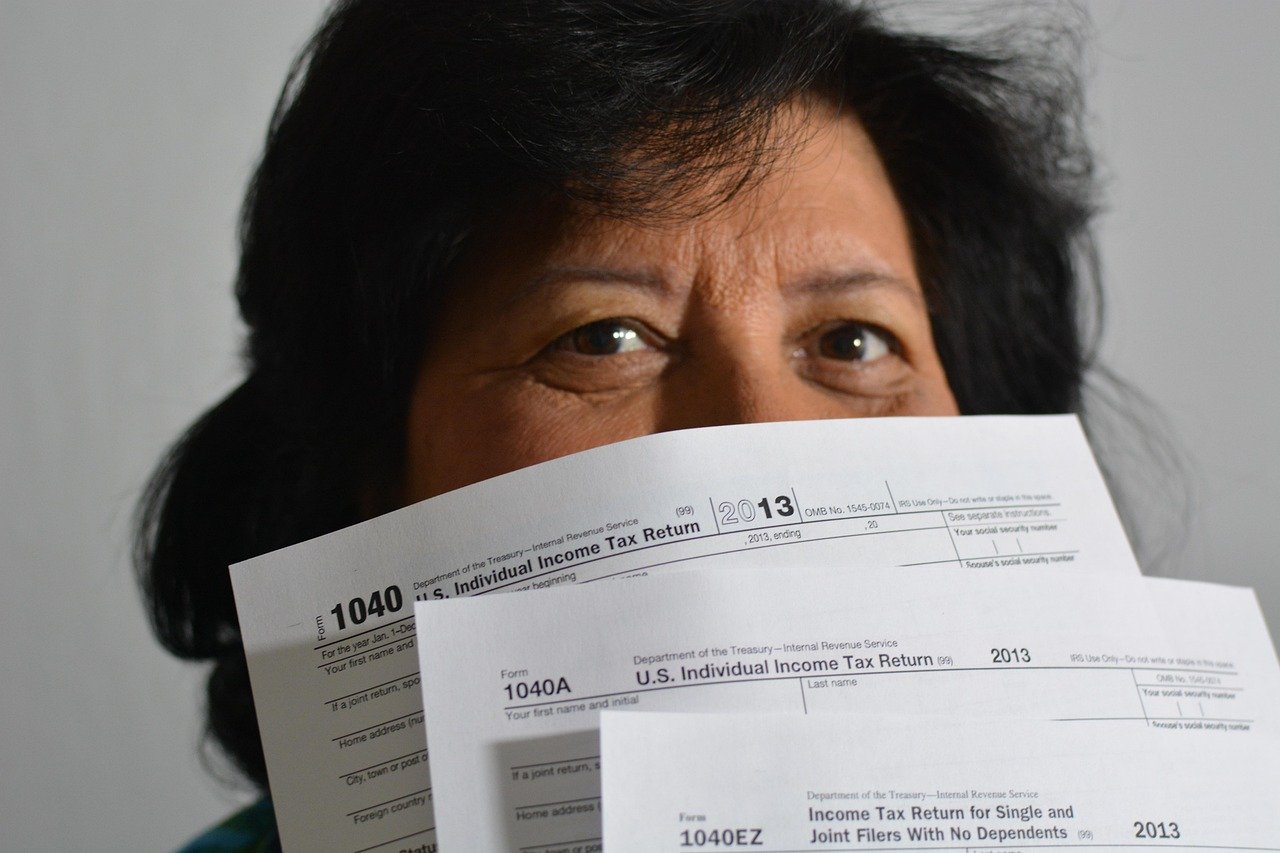

Trump’s tax plan aims to reduce the tax burden for individuals and businesses alike. For individuals, the proposal includes lowering the income tax rates across several brackets, increasing standard deductions, and enhancing child tax credits. For businesses, particularly small businesses which form a significant portion of the U.S. economy, there would be reductions in corporate tax rates and incentives for capital investments.

Economists suggest that these cuts could lead to an immediate surge in disposable income for many Americans. This increase in spending power might help stimulate consumer spending which is a vital driver of economic growth. Retail sectors, automotive industries, and real estate markets are just a few areas that could potentially see significant boosts as consumers have more cash to spend.

However, there are concerns among some economists regarding long-term implications. Tax cuts could lead to larger federal deficits if not balanced by equal cuts in government spending or by higher-than-expected economic growth. The increase in government debt could potentially lead to higher interest rates which might negate some of the benefits of these tax cuts over time.

Furthermore, while middle-class families might see immediate relief from such tax reductions, there’s an ongoing debate about how much of this benefit will trickle down to lower-income groups who tend to save less money out of necessity rather than choice. Additionally, these cuts could exacerbate income inequality if wealthier households receive disproportionately larger cuts than middle or lower-income families.

From a political standpoint, Trump’s proposal is seen as an appealing strategy for rallying support among voters who would welcome immediate financial relief. However, it also poses risks as opponents argue that fiscal responsibility might be compromised in favor of short-term gains.

In conclusion while Trumps new tax cut proposal might indeed “shower Americans with cash” initially supporters and detractors alike are waiting to see how these plans will address long-term economic stability issues while achieving their intended effects on growth and prosperity